In an effort to kick-start the economy the Government is allowing businesses to claim 130% on qualifying plant and machinery investments for expenditure incurred from 1 April 2021 until the end of March 2023. Under the super-deduction, for every pound a company invests, their taxes are cut by up to 25p. This change makes the UK’s capital allowance regime more internationally competitive.

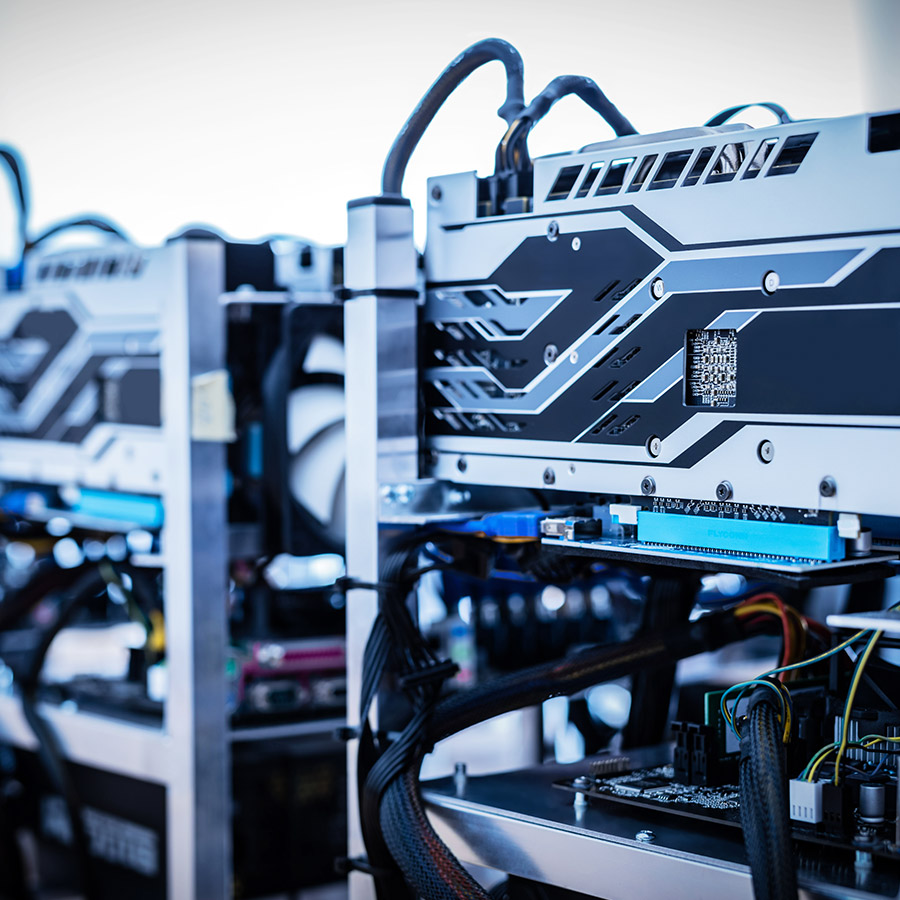

Plant and machinery for these purposes includes "Computer equipment and servers."

For more information go to the Government website - www.gov.uk